What is a Declaration Page for Car Insurance and Why Does it Matter?

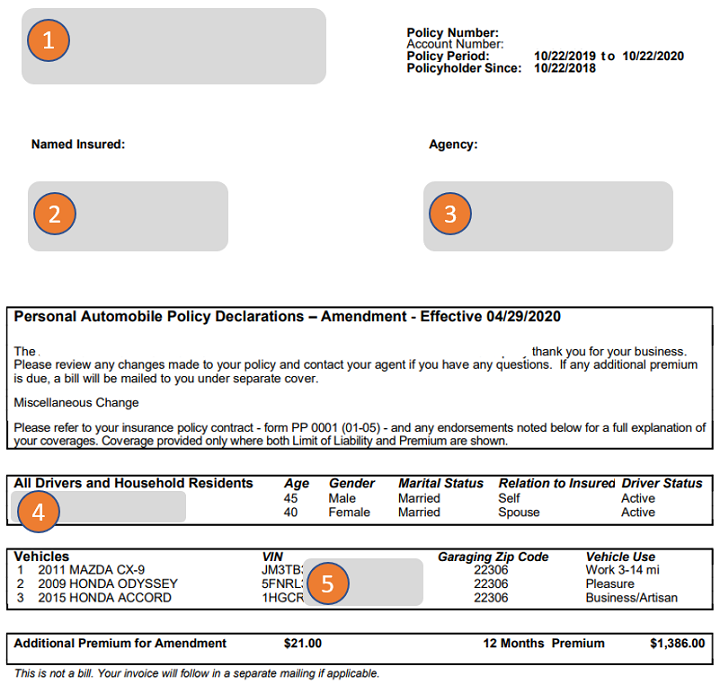

In the intricate world of car insurance, the declaration page serves as a crucial document, offering a snapshot of your policy’s key details. It’s a document you’ll likely encounter at various stages, from purchasing insurance to filing a claim, making it essential to understand its significance. Think of it as a concise summary of your car insurance policy, outlining the coverage you’ve secured, the insured individuals, and the limits of your protection. It’s a document that provides a clear picture of your insurance agreement and helps you navigate the often complex landscape of car insurance. What is a Declaration Page? The declaration page, also known as a policy summary or certificate of insurance, is a crucial document that Artikels the key details of your car insurance policy. It acts as a concise summary of your coverage, providing essential information at a glance. Information Included on a Declaration Page The declaration page typically includes the following critical information: Policyholder Information: This section lists the name, address, and contact information of the policyholder, who is the person or entity responsible for paying the insurance premiums. Policy Number: This unique identifier helps distinguish your policy from others and is essential for communication with the insurance company. Effective Dates: These dates indicate the period during which your insurance coverage is active. Vehicle Information: The declaration page details the make, model, year, and vehicle identification number (VIN) of the insured vehicle. Coverage Limits: This section specifies the maximum amount your insurance company will pay for covered losses, such as liability, collision, comprehensive, and medical payments. Deductibles: Deductibles represent the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. The declaration page clearly states the deductibles for each type of coverage. Premium Amount: The declaration page shows the total premium you are paying for the insurance policy, which can be paid in installments or as a lump sum. Named Insured: This section identifies the individuals covered by the policy, such as the policyholder and any additional drivers. Comparison with Other Insurance Documents While the declaration page provides a concise overview of your policy, it is not a substitute for the full insurance policy document. The policy document contains the complete terms and conditions of your coverage, including specific exclusions and limitations. The declaration page acts as a summary, providing essential information in an easily digestible format. It is frequently used for proof of insurance, while the full policy document provides detailed legal information. Importance of the Declaration Page The declaration page, also known as the policy summary, is a crucial document for car insurance policyholders. It serves as a concise and comprehensive overview of your insurance coverage, outlining key details and providing proof of insurance. Proof of Insurance The declaration page serves as a vital document for proving that you have valid car insurance. It contains essential information such as: * Policyholder’s Name: The name of the person or entity covered by the policy. * Policy Number: A unique identifier for your insurance policy. * Vehicle Identification Number (VIN): A specific code that identifies your vehicle. * Coverage Details: The types of coverage you have, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. * Policy Effective Dates: The start and end dates of your insurance coverage. * Premium Amount: The amount you pay for your insurance policy. * Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. “The declaration page is essentially a summary of your insurance policy, providing proof of coverage in a readily accessible format.” - [Insurance Industry Expert] This information is crucial in various situations, such as: Traffic Stops: Law enforcement officers may request proof of insurance during traffic stops. The declaration page serves as valid documentation. Accidents: In case of an accident, the declaration page can be presented to the other party involved, demonstrating that you have the required insurance coverage. Registration and Licensing: Some states require proof of insurance for vehicle registration and licensing. Scenario: Using the Declaration Page in an Accident Imagine you’re involved in a car accident. The other driver requests proof of insurance. You can readily present your declaration page, which clearly states your policy number, coverage details, and effective dates. This demonstrates that you have the necessary insurance coverage, facilitating the exchange of information and potentially expediting the claims process. Components of a Declaration Page The declaration page is a crucial document that summarizes the key details of your car insurance policy. It acts as a concise overview of your coverage, providing essential information for both you and your insurer. Understanding the components of this page is essential for making informed decisions about your car insurance. Sections of a Declaration Page The declaration page typically includes several key sections that Artikel the specific details of your insurance policy. Each section provides vital information about your coverage, policy terms, and financial responsibilities. Section Description Example Policyholder Information This section lists the name, address, and contact information of the policyholder. It may also include information about the insured vehicle, such as the vehicle identification number (VIN) and the year, make, and model. Policyholder: John Doe, Address: 123 Main Street, City: Anytown, State: CA, Zip: 12345, Vehicle: 2023 Toyota Camry, VIN: 123ABC456DEF … Read more