The burgeoning solar energy sector faces unique risks, demanding specialized insurance solutions. Solar farm insurance isn’t just about covering equipment; it’s about safeguarding a significant investment against a range of potential threats, from natural disasters and equipment malfunction to liability issues and evolving regulatory landscapes. This guide navigates the complexities of this critical aspect of solar farm ownership and operation, providing insights into policy types, risk assessment, claims processes, and future trends.

Understanding solar farm insurance is crucial for developers, investors, and operators alike. The cost of coverage, the breadth of protection offered, and the intricacies of the claims process can significantly impact the profitability and longevity of a solar farm project. This detailed analysis explores these aspects, offering practical advice and highlighting key considerations for navigating this specialized insurance market.

Types of Solar Farm Insurance Coverage

Securing adequate insurance is paramount for solar farm owners, mitigating substantial financial risks associated with operational disruptions and unforeseen events. A comprehensive insurance strategy should encompass various policy types tailored to the specific vulnerabilities of a solar energy facility. The choice of coverage significantly impacts both operational continuity and the overall financial health of the project.

Several key insurance policies are typically considered for solar farms. The specific needs and optimal coverage will vary based on factors such as location, project size, technology used, and the ownership structure. Understanding the nuances of each policy is critical for informed decision-making.

Property Insurance

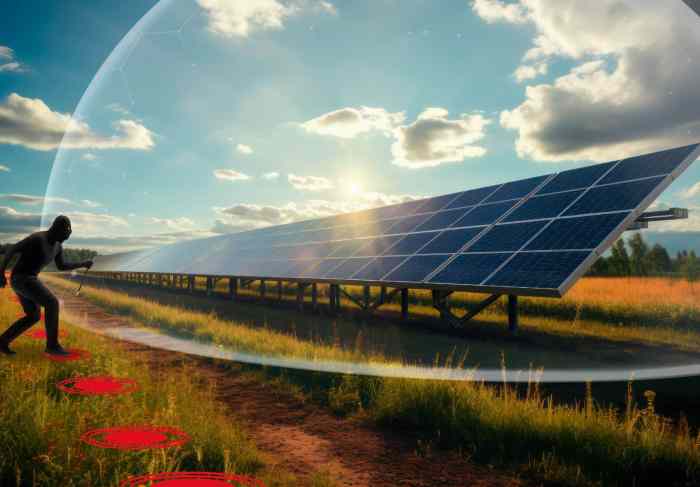

Property insurance protects the physical assets of the solar farm, including solar panels, inverters, mounting structures, and other equipment. This coverage typically includes protection against damage from various perils, such as fire, windstorms, hail, vandalism, and even acts of terrorism. The policy will specify the extent of coverage, including the replacement cost of damaged equipment or the cost of repairs.

Premiums are influenced by factors such as the location’s susceptibility to natural disasters, the value of the insured assets, and the farm’s security measures. For example, a farm located in a hurricane-prone region will likely command higher premiums than one situated in a less volatile area.

Business Interruption Insurance

Business interruption insurance compensates for lost revenue resulting from covered incidents that disrupt the solar farm’s operations. This is crucial as even temporary outages can significantly impact income generation. For instance, a fire damaging the inverter station would lead to production loss until repairs are completed. The policy covers the loss of income during the downtime, helping to maintain financial stability.

The cost of this coverage depends on the projected revenue, the farm’s operational history, and the likelihood of business interruption events in the specific location. A farm with a proven track record of consistent production will likely secure lower premiums than a newer, less established project.

Liability Insurance

Liability insurance protects the solar farm owner from claims of bodily injury or property damage caused by the operation of the facility. This is crucial to cover potential liabilities arising from accidents or incidents on the site, such as a visitor injuring themselves on the property. The coverage can extend to third-party claims and legal defense costs. The cost of liability insurance depends on factors such as the farm’s size, location, and the potential risks associated with its operation.

A larger farm with a more complex layout might have higher premiums than a smaller, simpler facility.

Cybersecurity Insurance

With the increasing reliance on sophisticated monitoring and control systems, cybersecurity insurance is becoming increasingly important for solar farms. This coverage protects against financial losses stemming from data breaches, cyberattacks, or system failures. Such incidents can disrupt operations, lead to data loss, and potentially expose the farm to significant financial liabilities. The cost of this insurance reflects the sophistication of the farm’s IT infrastructure and the potential vulnerabilities it faces.

A farm utilizing advanced monitoring systems and cloud-based data storage might have higher premiums due to the increased complexity and potential attack surface.

Assessing Risk in Solar Farm Insurance

Solar farm insurance, while seemingly straightforward, involves a complex interplay of factors influencing both the risk profile and the resulting premiums. A thorough risk assessment is crucial for both insurers and farm owners, ensuring appropriate coverage and fair pricing. This assessment goes beyond simply evaluating the physical assets; it delves into operational factors, environmental considerations, and even the broader economic landscape.Understanding the multifaceted nature of risk in solar farm insurance requires a detailed examination of several key areas.

This analysis focuses on identifying those key risk factors, the methodologies employed for quantification, and the direct impact of these assessments on the final insurance premium.

Key Risk Factors in Solar Farm Operation

Several factors contribute to the risk profile of a solar farm. These include, but are not limited to, the geographical location, the specific technology employed, the quality of construction and maintenance, and the potential for natural disasters or human-caused damage. A comprehensive risk assessment carefully weighs each of these factors. For example, a farm located in a hurricane-prone region will naturally command a higher premium than one situated in a stable, low-risk area.

Similarly, older technologies with a proven history of malfunction may be viewed as riskier than newer, more reliable systems.

Methods for Assessing and Quantifying Risk

Insurers employ a variety of methods to assess and quantify the risks associated with solar farms. These methods often involve a combination of quantitative and qualitative analyses. Quantitative methods might include statistical modeling based on historical weather data, failure rates of specific components, and claims history for similar projects. Qualitative assessments may involve on-site inspections, reviews of maintenance protocols, and analysis of the farm’s overall design and construction quality.

Sophisticated algorithms and actuarial models are frequently used to integrate these data points into a comprehensive risk score. This score, in turn, directly influences the premium calculation.

Risk Assessment and Insurance Premiums

The direct correlation between risk assessment and insurance premiums is undeniable. A higher risk score, reflecting a greater likelihood of claims, will inevitably lead to a higher premium. For instance, a solar farm situated in an area with frequent hailstorms and exhibiting a history of component failures might receive a premium significantly higher than a similarly sized farm located in a stable climate and boasting a robust maintenance program.

Conversely, farms demonstrating proactive risk mitigation strategies, such as advanced fire suppression systems or robust cybersecurity measures, might qualify for lower premiums. The precise relationship between risk score and premium is proprietary to each insurer, but the general principle remains consistent across the industry. Insurers might use a tiered system, offering varying levels of coverage and premium based on the assessed risk profile.

Claims Process for Solar Farm Damage

Filing a claim for damage to a solar farm can be a complex process, requiring meticulous documentation and a thorough understanding of your insurance policy. A swift and successful claim hinges on proactive preparation and adherence to the insurer’s guidelines. This section Artikels the typical steps involved and provides guidance on avoiding common pitfalls.The process generally begins with immediate notification of the insurer.

Prompt reporting allows for a timely assessment of the damage and facilitates a smoother claims resolution. Delaying notification can lead to complications and potentially impact the claim’s outcome.

Initial Claim Notification

Following a damaging event, such as a hailstorm or fire, the policyholder should immediately contact their insurance provider. This notification should include details of the incident, including date, time, and a brief description of the damage. A preliminary assessment of the extent of damage should be made, if possible, and communicated to the insurer. Photos and videos documenting the damage are highly recommended.

Many insurers have online portals or dedicated phone lines for reporting claims, streamlining the initial contact.

Damage Assessment and Investigation

Once the initial notification is received, the insurer will typically initiate a damage assessment. This may involve an on-site inspection by a qualified adjuster who will document the extent of the damage, assess the cause, and determine the value of the losses. This investigation is crucial for determining the validity and amount of the claim. Cooperation with the adjuster during this phase is essential.

Providing access to the site and any relevant documentation will expedite the process. For example, if the damage is due to a fire, providing fire department reports would be beneficial.

Claim Documentation and Submission

The claim documentation will vary depending on the insurer and the nature of the damage. However, generally, this includes a completed claim form, detailed descriptions of the damage, supporting documentation such as purchase invoices for the affected equipment, photos and videos of the damage, and any relevant reports from external parties such as contractors or engineers. Failure to provide complete and accurate documentation can lead to claim delays or denials.

Maintaining thorough records throughout the lifetime of the solar farm is crucial in such circumstances.

Claim Review and Settlement

Following the submission of all necessary documentation, the insurer will review the claim and determine the extent of coverage based on the policy terms and the findings of the damage assessment. This review process may take several weeks, depending on the complexity of the claim. The insurer may negotiate with the policyholder regarding the settlement amount. If the claim is approved, the insurer will issue payment according to the terms of the policy.

Clear and open communication with the insurer throughout this phase is crucial.

Common Reasons for Claim Denials and Avoidance Strategies

Claim denials often stem from incomplete documentation, failure to meet policy requirements (e.g., timely notification), or evidence suggesting the damage was not covered under the policy terms. For instance, a claim for damage caused by neglect or improper maintenance might be denied. Similarly, insufficient or inaccurate documentation can lead to delays or rejection. To avoid denials, policyholders should meticulously document all aspects of the solar farm’s operation, maintenance, and any damage events.

Regular inspections and preventative maintenance can also minimize the risk of damage and strengthen a claim’s validity. Furthermore, ensuring a clear understanding of the policy terms and conditions is paramount.

The Role of Actuaries in Solar Farm Insurance

Actuaries play a critical role in the solar farm insurance market, acting as the quantitative backbone of the industry. Their expertise in assessing and managing risk is paramount in determining premiums, designing policies, and ensuring the financial stability of insurance providers. Their work underpins the entire insurance ecosystem for these large-scale renewable energy projects.Actuaries utilize sophisticated statistical models and historical data to predict future losses and appropriately price insurance policies for solar farms.

This involves a complex interplay of various factors, ranging from weather patterns and equipment failures to regulatory changes and market fluctuations. The accuracy of their predictions directly impacts the profitability of insurers and the affordability of premiums for solar farm owners.

Actuarial Models for Risk Assessment and Loss Prediction

Actuarial models used in solar farm insurance are complex and often incorporate several layers of analysis. These models begin by analyzing historical data on solar farm incidents, including equipment malfunctions (e.g., inverter failures, panel degradation), weather-related damage (e.g., hailstorms, wildfires), and theft or vandalism. This data is then used to estimate the probability of various types of losses and their associated costs.

Furthermore, the models incorporate factors such as the geographical location of the solar farm, the specific technology used (e.g., crystalline silicon, thin-film), the age and condition of the equipment, and the quality of maintenance practices. For instance, a model might predict a higher likelihood of hail damage for a solar farm located in a region prone to severe hailstorms compared to one in a more temperate climate.

Sophisticated algorithms are then employed to combine these factors and generate probabilistic loss forecasts. These forecasts are not merely point estimates; they usually involve a range of possible outcomes, allowing insurers to quantify uncertainty and set premiums accordingly. For example, a model might predict an expected loss of $1 million with a 95% confidence interval ranging from $500,000 to $1.5 million.

This allows insurers to price policies to cover potential losses within this range, while maintaining a profit margin.

Actuarial Data’s Influence on Insurance Policy Design

Actuarial data significantly influences the design of insurance policies for solar farms. By analyzing historical loss data and predicting future trends, actuaries can identify specific risks and develop coverage options that address them effectively. This might involve creating specialized policies for specific types of solar farms or incorporating risk mitigation measures into the policy design. For example, if actuarial data reveals a high incidence of fire-related losses due to faulty wiring, insurers might include stricter inspection requirements or offer discounts for solar farms that adopt enhanced fire safety measures.

Similarly, if data suggests a correlation between panel degradation and specific manufacturer brands, insurers may adjust premiums based on the type of panels used in a particular solar farm. The premiums themselves are directly derived from actuarial assessments of risk, balancing the expected losses with the desired profit margin for the insurance company. Policies might also offer different deductible levels, reflecting the risk profile and the willingness of the solar farm owner to share in the potential losses.

The outcome is a tailored insurance product that reflects the specific risks associated with the insured solar farm, while maintaining financial viability for the insurer.

Legal and Regulatory Aspects of Solar Farm Insurance

The insurance landscape for solar farms is complex, shaped by a patchwork of federal, state, and sometimes even local regulations. Understanding these legal frameworks is crucial for both insurers and solar farm developers to ensure adequate coverage and compliance. Failure to navigate these complexities can lead to significant financial and operational setbacks.The legal frameworks governing solar farm insurance are multifaceted, drawing from general insurance law, energy regulations, and environmental statutes.

These regulations often dictate minimum coverage requirements, reporting obligations, and dispute resolution mechanisms. The specific requirements vary considerably depending on location, the size and type of solar farm, and the specific risks involved. This necessitates a careful and comprehensive approach to risk assessment and policy selection.

State-Specific Insurance Requirements

Many states have specific regulations regarding the insurance requirements for renewable energy projects, including solar farms. These requirements often cover liability for bodily injury, property damage, and pollution. For instance, some states mandate minimum liability limits for specific types of incidents, such as wildfires sparked by faulty equipment or chemical spills during construction. Other states might require specific endorsements or riders addressing environmental liabilities associated with decommissioning or the disposal of solar panels at the end of their lifespan.

Compliance with these state-specific regulations is paramount to avoid penalties and ensure the validity of insurance policies. Failure to comply can result in the policy being deemed invalid, leaving the solar farm operator financially exposed.

Federal Regulations and Reporting

While federal regulations don’t typically dictate specific insurance requirements for solar farms, certain federal laws and agencies play a significant role. For example, the Environmental Protection Agency (EPA) regulations concerning hazardous waste disposal influence insurance coverage related to decommissioning and panel recycling. Furthermore, federal reporting requirements related to accidents or environmental incidents can impact the claims process and influence the insurer’s assessment of future risks.

Compliance with these federal guidelines is essential for maintaining operational legitimacy and securing future insurance coverage.

Implications of Non-Compliance

Non-compliance with insurance regulations can have severe consequences. This can include penalties and fines imposed by regulatory bodies, potential legal action from third parties affected by uninsured incidents, and difficulties securing future insurance coverage. Insurers may refuse to renew policies or offer coverage at significantly higher premiums if non-compliance is detected. Furthermore, lenders providing financing for solar farm projects may require evidence of full insurance compliance as a condition of their loan agreements.

The financial ramifications of non-compliance can be substantial, potentially jeopardizing the viability of the entire solar farm operation.

Impact of Natural Disasters on Solar Farm Insurance

Solar farms, while representing a significant step towards renewable energy, are not immune to the destructive forces of nature. The vulnerability of these large-scale installations to various natural disasters presents considerable challenges for insurers, demanding sophisticated risk assessment and tailored coverage options. The financial implications of widespread damage can be substantial, impacting both farm operators and insurance providers.

Hurricane Damage to Solar Farms

Hurricanes pose a significant threat to solar farms, primarily through high winds and flooding. Strong winds can dislodge solar panels, causing damage to the panels themselves, racking systems, and inverters. Flooding can submerge equipment, leading to short circuits and irreparable damage. Insurance policies often address these risks through comprehensive coverage that includes wind and flood damage, but policy limits and deductibles vary widely depending on location, farm size, and the specific terms of the contract.

For instance, a Category 5 hurricane impacting a coastal solar farm could result in total loss claims exceeding tens of millions of dollars, highlighting the need for robust insurance protection.

Wildfire Impacts on Solar Farms

Wildfires present a different set of challenges. While the solar panels themselves are relatively fire-resistant, the surrounding vegetation and infrastructure, such as transformers and cabling, are highly susceptible. Intense heat can melt wiring and damage inverters, while embers can ignite dry brush near the solar arrays, potentially spreading the fire. Insurance policies typically address wildfire damage under their fire and extended coverage provisions, but specific exclusions related to acts of God or negligence might apply.

The 2020 California wildfires, for example, resulted in significant damage to several utility-scale solar farms, illustrating the potential for substantial losses in wildfire-prone regions.

Hail Damage to Solar Farms

Hailstorms can cause significant damage to solar panels, particularly larger hail. Impacts can crack or shatter panels, rendering them ineffective. The severity of damage depends on the size and intensity of the hailstones and the type of panels used. Insurance policies usually cover hail damage under comprehensive coverage, but the extent of reimbursement will depend on the extent of the damage and any applicable deductibles.

A large hailstorm impacting a substantial area of a solar farm can lead to the replacement of hundreds or even thousands of panels, generating substantial claims costs.

Typical Coverage for Various Natural Disasters

| Natural Disaster | Typical Coverage | Exclusions (Potential) | Claim Considerations |

|---|---|---|---|

| Hurricane (Wind & Flood) | Wind damage to panels, racking, inverters; Flood damage to submerged equipment. | Negligence, pre-existing conditions, inadequate maintenance. | Detailed damage assessment, proof of loss, adherence to policy terms. |

| Wildfire | Fire damage to panels, wiring, transformers, and other infrastructure. | Acts of God (depending on policy wording), failure to comply with fire safety regulations. | Investigation of fire origin, documentation of damage, adherence to reporting deadlines. |

| Hail | Damage to solar panels caused by hail impact. | Wear and tear, pre-existing damage, improper installation. | Assessment of hail damage, photographic evidence, panel replacement costs. |

| Earthquake | Structural damage to racking systems, ground-mounted inverters. | Ground shifting due to soil conditions, lack of seismic design. | Geological surveys, structural engineering reports, cost of repairs or replacement. |

Technological Advancements and Solar Farm Insurance

The rapid evolution of solar technology is profoundly impacting the insurance landscape. Improved monitoring systems, predictive maintenance tools, and advanced materials are altering risk profiles, leading to a dynamic interplay between insurers and solar farm operators. This necessitates a reassessment of traditional underwriting practices and the development of more sophisticated insurance products tailored to the evolving needs of the industry.Improved monitoring and predictive maintenance are significantly reducing the frequency and severity of claims.

Real-time data analysis allows for early detection of potential problems, enabling proactive maintenance and minimizing downtime. This translates to lower overall risk for insurers, influencing premium calculations and potentially leading to more competitive pricing for solar farm owners.

Impact of Technology on Risk Assessment

Advanced sensors, drones, and satellite imagery provide insurers with unprecedented levels of data for assessing risk. These technologies enable more accurate evaluations of environmental factors such as weather patterns, soil conditions, and proximity to wildfire zones. Machine learning algorithms can analyze this data to predict potential failure points and identify areas requiring heightened attention. This granular level of analysis leads to more precise risk stratification and more tailored insurance policies, resulting in fairer premiums for low-risk solar farms.

For example, a farm equipped with advanced monitoring systems showing consistently low failure rates might qualify for a significantly lower premium compared to a farm lacking such capabilities. Similarly, farms located in areas with historically low lightning strike frequencies may receive preferential rates.

Influence of Technology on Claims Processes

Technological advancements streamline the claims process, reducing the time and cost associated with damage assessment and repair. Drones equipped with high-resolution cameras can quickly and efficiently survey damaged areas, providing detailed photographic evidence to support claims. This accelerates the assessment process and minimizes delays in compensation for insured losses. Furthermore, the use of blockchain technology can enhance transparency and security in the claims process, reducing the potential for fraud and disputes.

For instance, a damaged inverter can be documented using drone imagery and a timestamped blockchain entry, ensuring an accurate and verifiable record for insurance claim purposes.

Insurer Adaptation to Technological Advancements

Insurers are actively adapting their policies and underwriting practices to accommodate these technological changes. Many are now incorporating data from advanced monitoring systems into their risk assessment models, using this information to offer customized insurance packages based on individual solar farm characteristics. This includes offering tiered premiums based on the level of technological sophistication implemented at the solar farm.

Insurers are also investing in data analytics capabilities to better understand the correlation between technological advancements and claim frequency/severity, enabling them to refine their actuarial models and pricing strategies. The development of parametric insurance products, triggered by objective data from monitoring systems rather than subjective damage assessments, is another significant development reflecting this adaptation.

The Importance of Preventative Maintenance in Solar Farm Insurance

Preventative maintenance is paramount in mitigating risk and reducing insurance costs for solar farms. A proactive approach to maintenance significantly impacts the overall operational efficiency and longevity of the facility, directly influencing the likelihood and severity of insured events. This, in turn, translates to lower premiums and a more stable insurance landscape for operators.Regular maintenance directly influences insurers’ risk assessments.

By demonstrating a commitment to preventative measures, solar farm operators can significantly reduce the perceived risk associated with their operations. This lower risk profile leads to more favorable insurance terms, including lower premiums and potentially broader coverage options. Conversely, a history of neglecting maintenance can lead to higher premiums, restricted coverage, or even difficulty securing insurance altogether.

Impact of Preventative Maintenance on Insurance Premiums

Implementing a robust preventative maintenance program demonstrably reduces the frequency and severity of claims. For instance, regular cleaning of solar panels prevents energy loss and degradation, reducing the need for costly repairs or replacements down the line. Similarly, timely inspections and repairs of inverters and other critical components minimize the risk of system failures, preventing potentially extensive downtime and associated financial losses.

These reductions in claim frequency and severity directly translate to lower insurance premiums for the solar farm operator. A well-documented maintenance program can serve as strong evidence of risk mitigation, allowing insurers to offer more competitive rates. Conversely, a lack of maintenance often results in higher premiums to account for the increased risk of claims. This cost-benefit analysis highlights the financial advantages of preventative maintenance.

Best Practices for Preventative Maintenance in Solar Farms

A comprehensive preventative maintenance plan should encompass a range of activities performed on a regular schedule. Consistent adherence to these practices is crucial for minimizing risks and ensuring the long-term health and profitability of the solar farm.

- Regular Panel Cleaning: Scheduled cleaning, frequency depending on environmental conditions (e.g., desert vs. coastal), removes dirt, dust, and debris that can significantly reduce energy output. This should include visual inspection for cracks or damage.

- Inverter Inspections and Maintenance: Regular checks of inverters for overheating, unusual noises, or error codes are essential to prevent failures. This includes checking connections and ensuring proper ventilation.

- Grounding and Electrical System Checks: Regular inspections of grounding systems and electrical connections are critical for safety and to prevent electrical faults that could lead to fires or other damage. Testing should be conducted in accordance with relevant safety standards.

- Weed and Vegetation Control: Regular weed control around panels and equipment prevents shading and potential fire hazards. This includes managing vegetation growth around the perimeter of the farm.

- Structural Inspections: Periodic inspections of the mounting structures, ensuring stability and preventing damage from wind or other environmental factors. This may involve visual inspections and potentially more thorough assessments depending on the age and condition of the structures.

- Monitoring System Checks: Regular checks of the monitoring system ensure accurate data collection and early detection of potential problems. This allows for proactive intervention and prevents minor issues from escalating into major failures.

Comparing Solar Farm Insurance Providers

Choosing the right insurance provider for a solar farm is crucial, impacting both operational continuity and financial stability. The market offers a diverse range of insurers, each with varying coverage options, pricing structures, and claims processes. A thorough comparison is essential to secure optimal protection.Selecting an appropriate insurer requires careful consideration of several key factors. Beyond simply comparing premiums, businesses should evaluate the insurer’s financial strength, claims handling reputation, and the breadth of their coverage options to ensure a suitable fit for the specific risks associated with their solar farm.

Understanding the nuances of policy wording and exclusions is also paramount.

Key Factors in Selecting a Solar Farm Insurer

The selection of a solar farm insurer shouldn’t solely rely on price. Several critical factors demand careful evaluation. These include the insurer’s financial stability (rated by agencies like A.M. Best), their experience in insuring renewable energy assets, the responsiveness of their claims process, the comprehensiveness of their coverage, and the clarity of their policy terms and conditions. A strong track record of handling claims efficiently and fairly is vital, especially considering the potential for significant losses from events like hailstorms or wildfires.

Comparison of Solar Farm Insurance Providers

The following table offers a simplified comparison of hypothetical providers. Note that actual pricing and coverage details vary considerably depending on factors such as location, farm size, and specific risk profiles. It’s crucial to obtain personalized quotes from multiple insurers before making a decision.

| Insurer | Annual Premium (Example: $1M Coverage) | Coverage Highlights | Claims Handling Reputation |

|---|---|---|---|

| SolarGuard Insurance | $50,000 | Comprehensive coverage including weather damage, equipment failure, and business interruption. | Excellent, known for swift and fair claims processing. |

| SunShine Underwriters | $45,000 | Strong coverage for weather-related events, but limited business interruption coverage. | Good, but some delays reported in claim processing. |

| BrightFuture Assurance | $60,000 | Extensive coverage, including terrorism and cyber risks. | Average, mixed reviews on claim handling efficiency. |

| PowerSource Insurance | $55,000 | Focus on equipment failure and repairs, with limited weather damage coverage. | Good, efficient claims process for equipment-related damages. |

Future Trends in Solar Farm Insurance

The solar farm insurance market is undergoing a rapid transformation, driven by technological advancements, evolving regulatory landscapes, and the increasing prevalence of extreme weather events. Insurers are adapting their strategies to manage emerging risks and capitalize on new opportunities presented by this dynamic sector. This necessitates a proactive approach to risk assessment and product development to remain competitive and adequately protect both insurers and policyholders.The increasing scale and complexity of solar farms are significantly impacting the insurance landscape.

Larger projects with more sophisticated technologies present unique challenges for risk assessment and claims management. This trend necessitates the development of more specialized insurance products tailored to the specific needs of large-scale solar installations. Moreover, the integration of energy storage solutions, such as battery systems, introduces additional complexities that require careful consideration in policy design.

Increased Use of Predictive Analytics and AI

Insurers are increasingly leveraging predictive analytics and artificial intelligence (AI) to improve risk assessment and pricing accuracy. By analyzing vast datasets encompassing weather patterns, equipment performance, and historical claims data, insurers can identify high-risk areas and develop more precise underwriting models. For example, AI-powered systems can analyze satellite imagery to assess the condition of solar panels and predict potential maintenance needs, leading to more accurate risk profiling and potentially lower premiums for well-maintained farms.

This allows for a more nuanced approach to risk assessment, moving beyond simple geographic location and incorporating a wider range of factors.

Growing Importance of Cyber Risk Insurance

The increasing reliance on digital technologies in solar farm operations introduces significant cyber risks. Data breaches, ransomware attacks, and system failures can lead to substantial financial losses and operational disruptions. Consequently, cyber risk insurance is becoming a crucial component of comprehensive solar farm insurance packages. This includes coverage for data breaches, business interruption due to cyberattacks, and the costs associated with remediation and recovery efforts.

Insurers are actively developing specialized cyber insurance products to address the unique vulnerabilities of solar farms, often integrating these policies with broader property and liability coverage.

Development of Parametric Insurance Products

Parametric insurance, which provides payouts based on pre-defined triggers such as wind speed or rainfall intensity, is gaining traction in the solar farm insurance market. These products offer faster and more efficient claims processing compared to traditional indemnity-based policies, which require detailed damage assessments. This is particularly beneficial in the context of natural disasters, where rapid payouts are crucial for business continuity.

For instance, a parametric policy might provide immediate compensation based on the intensity of a hurricane, allowing solar farm operators to quickly begin repairs and mitigate further losses. This streamlined approach reduces administrative burden and improves the speed of financial relief for policyholders.

Focus on Renewable Energy-Specific Expertise

The complexities of solar farm technology and operations require insurers to develop specialized expertise in the renewable energy sector. This includes recruiting professionals with deep understanding of solar panel technology, energy storage systems, and grid integration. Insurers are investing in training programs and partnerships with renewable energy experts to enhance their underwriting capabilities and claims handling processes. This specialized knowledge allows insurers to better assess risks, design appropriate insurance products, and effectively manage claims related to technical failures or operational issues.

Companies with such specialized teams are likely to gain a competitive edge in this increasingly complex market.

Case Studies of Solar Farm Insurance Claims

Solar farm insurance claims offer valuable insights into the risks and vulnerabilities inherent in large-scale renewable energy projects. Analyzing these claims reveals crucial information for insurers, developers, and operators alike, impacting future risk assessment, policy design, and operational strategies. The following case studies illustrate the diversity of claims and the importance of comprehensive insurance coverage.

Hail Damage in Nebraska

A large-scale solar farm in Nebraska experienced significant hail damage during a severe summer storm. The hail, ranging in size from golf balls to baseballs, caused widespread damage to solar panels, resulting in numerous cracked cells and broken frames. The resulting claim totaled over $2 million, encompassing the cost of panel replacement, labor, and system testing to ensure operational integrity.

The insurer, after thorough investigation and assessment, covered the majority of the claim, but a deductible and specific exclusions in the policy resulted in a significant out-of-pocket expense for the farm owner. This case highlights the importance of assessing regional weather patterns and selecting policies with appropriate coverage limits for severe weather events.

Fire Damage in California

A wildfire in California threatened a nearby solar farm. Although the fire did not directly engulf the solar panels, intense heat and smoke caused damage to several inverters and wiring systems. The resulting claim focused on the replacement of damaged equipment and the associated downtime costs. The insurer, after considering the proximity of the fire and the resulting indirect damage, approved the claim.

This case study underscores the importance of considering indirect damage caused by natural disasters, especially in fire-prone regions. The policy’s definition of “covered peril” and “consequential loss” played a significant role in the claim’s outcome.

Equipment Malfunction in Arizona

A solar farm in Arizona experienced a series of equipment malfunctions stemming from a manufacturing defect in a batch of inverters. The malfunction led to reduced energy output and potential for further damage. The claim involved the replacement of the defective inverters and a thorough system inspection to rule out other potential issues. The manufacturer’s warranty initially covered part of the cost, but the insurer stepped in to cover remaining expenses, emphasizing the importance of layered insurance coverage encompassing both manufacturer defects and operational failures.

The claim process highlighted the value of having clear contractual agreements with equipment suppliers and comprehensive insurance policies that address potential manufacturer defects.

Hypothetical Claim Scenario: Lightning Strike

A 100-megawatt solar farm in Texas experiences a direct lightning strike during a thunderstorm. The strike damages several strings of solar panels, causing localized fires and significant damage to the central inverter station. The farm operator immediately reports the incident to their insurer and provides photographic and video evidence of the damage. A claims adjuster is dispatched to the site to assess the extent of the damage and verify the cause.

The adjuster works with electrical engineers and solar panel experts to determine the repair costs. The insurer utilizes drone technology to survey the site for additional damage not immediately visible. The claim process takes approximately six weeks, involving multiple inspections and negotiations. The insurer ultimately approves a claim covering panel replacement, inverter repair, and associated labor costs, with a small deduction due to a policy deductible.

This scenario demonstrates the importance of prompt reporting, comprehensive documentation, and cooperation with the insurer throughout the claims process. The use of advanced technologies in damage assessment is also crucial for efficient and accurate claim settlement.

Wrap-Up

Securing appropriate solar farm insurance is paramount for mitigating financial risk and ensuring the long-term viability of renewable energy projects. From understanding the nuances of various policy types to proactively managing risk through preventative maintenance and technological advancements, a comprehensive approach to insurance is essential. By carefully considering the factors Artikeld in this guide, solar farm owners and operators can make informed decisions to protect their investments and contribute to the sustainable growth of the solar energy industry.