In the intricate world of car insurance, the declaration page serves as a crucial document, offering a snapshot of your policy’s key details. It’s a document you’ll likely encounter at various stages, from purchasing insurance to filing a claim, making it essential to understand its significance.

Think of it as a concise summary of your car insurance policy, outlining the coverage you’ve secured, the insured individuals, and the limits of your protection. It’s a document that provides a clear picture of your insurance agreement and helps you navigate the often complex landscape of car insurance.

What is a Declaration Page?

The declaration page, also known as a policy summary or certificate of insurance, is a crucial document that Artikels the key details of your car insurance policy. It acts as a concise summary of your coverage, providing essential information at a glance.

Information Included on a Declaration Page

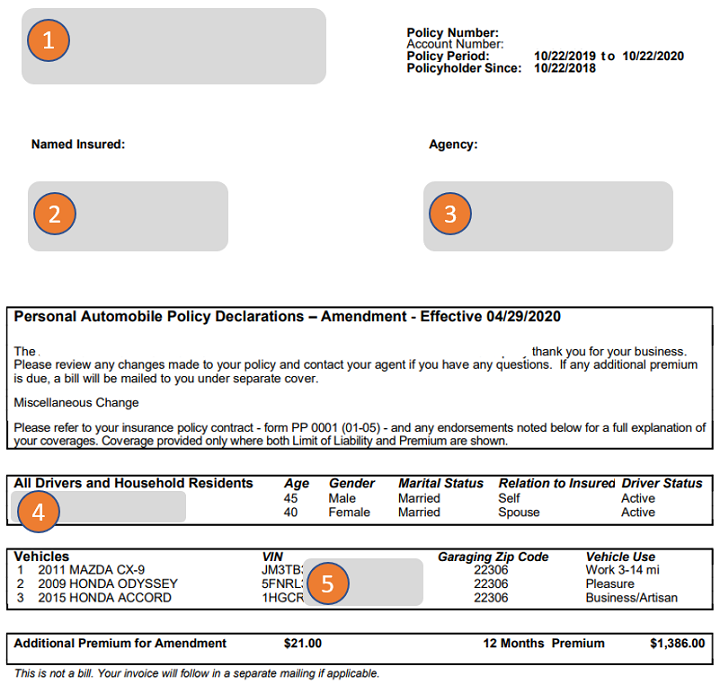

The declaration page typically includes the following critical information:

- Policyholder Information: This section lists the name, address, and contact information of the policyholder, who is the person or entity responsible for paying the insurance premiums.

- Policy Number: This unique identifier helps distinguish your policy from others and is essential for communication with the insurance company.

- Effective Dates: These dates indicate the period during which your insurance coverage is active.

- Vehicle Information: The declaration page details the make, model, year, and vehicle identification number (VIN) of the insured vehicle.

- Coverage Limits: This section specifies the maximum amount your insurance company will pay for covered losses, such as liability, collision, comprehensive, and medical payments.

- Deductibles: Deductibles represent the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. The declaration page clearly states the deductibles for each type of coverage.

- Premium Amount: The declaration page shows the total premium you are paying for the insurance policy, which can be paid in installments or as a lump sum.

- Named Insured: This section identifies the individuals covered by the policy, such as the policyholder and any additional drivers.

Comparison with Other Insurance Documents

While the declaration page provides a concise overview of your policy, it is not a substitute for the full insurance policy document. The policy document contains the complete terms and conditions of your coverage, including specific exclusions and limitations.

The declaration page acts as a summary, providing essential information in an easily digestible format. It is frequently used for proof of insurance, while the full policy document provides detailed legal information.

Importance of the Declaration Page

The declaration page, also known as the policy summary, is a crucial document for car insurance policyholders. It serves as a concise and comprehensive overview of your insurance coverage, outlining key details and providing proof of insurance.

Proof of Insurance

The declaration page serves as a vital document for proving that you have valid car insurance. It contains essential information such as:

* Policyholder’s Name: The name of the person or entity covered by the policy.

* Policy Number: A unique identifier for your insurance policy.

* Vehicle Identification Number (VIN): A specific code that identifies your vehicle.

* Coverage Details: The types of coverage you have, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

* Policy Effective Dates: The start and end dates of your insurance coverage.

* Premium Amount: The amount you pay for your insurance policy.

* Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

“The declaration page is essentially a summary of your insurance policy, providing proof of coverage in a readily accessible format.” - [Insurance Industry Expert]

This information is crucial in various situations, such as:

- Traffic Stops: Law enforcement officers may request proof of insurance during traffic stops. The declaration page serves as valid documentation.

- Accidents: In case of an accident, the declaration page can be presented to the other party involved, demonstrating that you have the required insurance coverage.

- Registration and Licensing: Some states require proof of insurance for vehicle registration and licensing.

Scenario: Using the Declaration Page in an Accident

Imagine you’re involved in a car accident. The other driver requests proof of insurance. You can readily present your declaration page, which clearly states your policy number, coverage details, and effective dates. This demonstrates that you have the necessary insurance coverage, facilitating the exchange of information and potentially expediting the claims process.

Components of a Declaration Page

The declaration page is a crucial document that summarizes the key details of your car insurance policy. It acts as a concise overview of your coverage, providing essential information for both you and your insurer. Understanding the components of this page is essential for making informed decisions about your car insurance.

Sections of a Declaration Page

The declaration page typically includes several key sections that Artikel the specific details of your insurance policy. Each section provides vital information about your coverage, policy terms, and financial responsibilities.

| Section | Description | Example |

|---|---|---|

| Policyholder Information | This section lists the name, address, and contact information of the policyholder. It may also include information about the insured vehicle, such as the vehicle identification number (VIN) and the year, make, and model. | Policyholder: John Doe, Address: 123 Main Street, City: Anytown, State: CA, Zip: 12345, Vehicle: 2023 Toyota Camry, VIN: 123ABC456DEF |

| Policy Number | This is a unique identifier assigned to your specific insurance policy. It’s essential for referencing your policy and accessing information related to it. | Policy Number: 1234567890 |

| Effective Dates | This section indicates the start and end dates of your insurance coverage. It determines the period during which your policy is active and provides coverage. | Effective Dates: 01/01/2023 - 12/31/2023 |

| Coverage Details | This section Artikels the specific types of coverage included in your policy, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It may also specify the coverage limits for each type of insurance. | Liability Coverage: $100,000 per person/$300,000 per accident, Collision Coverage: $500 deductible, Comprehensive Coverage: $500 deductible |

| Premium and Payment Information | This section details the premium amount you pay for your insurance policy. It may also specify the payment frequency (e.g., monthly, quarterly, annually) and the payment method (e.g., credit card, bank draft). | Premium: $100 per month, Payment Frequency: Monthly, Payment Method: Credit Card |

| Deductibles | This section lists the amount you are responsible for paying out-of-pocket for covered losses, such as accidents or theft. The deductible amount is subtracted from the total cost of the claim before your insurance coverage kicks in. | Collision Deductible: $500, Comprehensive Deductible: $500 |

| Named Insured | This section identifies the individual or individuals who are covered by the insurance policy. It may include the names of all drivers authorized to operate the insured vehicle. | Named Insured: John Doe, Authorized Drivers: John Doe, Jane Doe |

| Vehicle Information | This section provides details about the insured vehicle, including the year, make, model, VIN, and any other relevant information. It may also include the vehicle’s usage (e.g., personal, business) and location (e.g., home address, garage address). | Vehicle: 2023 Toyota Camry, VIN: 123ABC456DEF, Usage: Personal, Location: 123 Main Street, Anytown, CA |

How to Obtain a Declaration Page

The declaration page, also known as a policy summary, is an essential document that summarizes your car insurance policy. It’s a crucial document to have on hand when you need to provide proof of insurance.

Accessing Your Declaration Page

The most convenient way to access your declaration page is through your insurance company’s online portal or mobile app. Most insurance companies allow policyholders to view and download their declaration pages online.

- Online Portal: Most insurance companies have a secure online portal where you can log in to access your policy information. This portal typically provides a section for viewing and downloading your declaration page.

- Mobile App: Many insurance companies offer mobile apps that allow you to manage your policy on the go. These apps usually provide access to your declaration page as well.

Understanding Your Coverage

The declaration page serves as a concise summary of your car insurance policy, outlining key details about your coverage. By carefully reviewing the information provided, you can gain a comprehensive understanding of the protection you have in place.

Coverage Limits and Deductibles

The declaration page clearly Artikels the financial limits and deductibles associated with each type of coverage you have purchased. This information is crucial for understanding your financial responsibility in the event of an accident or other covered event.

Coverage limits represent the maximum amount your insurer will pay for a covered claim.

For instance, your declaration page might specify a liability coverage limit of $100,000 per person and $300,000 per accident. This means that your insurer will cover up to $100,000 in damages to any single person injured in an accident caused by you, and up to $300,000 in total damages for all injured parties in that accident.

Deductibles represent the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

Your declaration page might state a deductible of $500 for collision coverage. This means that if you are involved in an accident and damage your own car, you will be responsible for paying the first $500 of repair costs, and your insurer will cover the remaining expenses up to your coverage limit.

Relationship Between Declaration Page and Insurance Policy

The declaration page serves as a key component of your car insurance policy. It summarizes the essential details of your coverage, but it does not replace the complete policy document. The full policy document provides detailed information about your coverage, including specific terms, conditions, and exclusions.

The declaration page acts as a concise reference point for understanding the key features of your coverage. If you have any questions about your coverage, it’s always best to consult your full policy document or contact your insurance agent for clarification.

Making Changes to Your Policy

Your declaration page is a snapshot of your car insurance policy at a specific point in time. However, life is full of changes, and your insurance needs may evolve alongside them. It’s essential to keep your declaration page updated to reflect these changes, ensuring your policy remains accurate and meets your current requirements.

Updating Your Declaration Page

When changes occur in your life that impact your car insurance, it’s crucial to notify your insurance company. These changes could include adding a new driver to your policy, purchasing a new vehicle, moving to a new address, or experiencing changes in your driving record. Failure to update your policy can result in inadequate coverage, potential financial losses in the event of an accident, and even policy cancellation.

Importance of Notifying Your Insurance Company

- Accurate Coverage: Changes to your vehicle, address, or driving record can affect your insurance premiums and coverage levels. Updating your policy ensures that you have the right coverage for your specific needs.

- Avoid Policy Cancellation: Insurance companies rely on accurate information to assess risk and determine premiums. Failing to notify your insurance company of significant changes could lead to policy cancellation, leaving you without coverage.

- Potential Financial Losses: In the event of an accident, an outdated declaration page could result in inadequate coverage, leaving you responsible for significant out-of-pocket expenses.

Tips for Keeping Your Declaration Page Accurate

- Communicate Promptly: Immediately notify your insurance company of any changes to your vehicle, address, or driving record.

- Document Changes: Keep records of all changes made to your policy, including dates, details, and any communication with your insurance company.

- Review Your Policy Regularly: Make it a habit to review your declaration page at least once a year to ensure it accurately reflects your current situation.

- Contact Your Insurance Agent: If you have any questions about updating your policy or are unsure about the process, contact your insurance agent for guidance.

Declaration Page and Claims

The declaration page serves as a crucial document in the claims process, providing essential information about your car insurance policy that helps determine your coverage and guide the claim settlement.

Verification of Coverage

The declaration page confirms the existence of your car insurance policy, acting as a primary source of information for insurance companies to verify your coverage. Key details on the page, such as your policy number, coverage dates, and insured vehicles, allow insurance companies to confirm that you are indeed insured and that the claim falls within the policy’s coverage period.

Declaration Page and Renewals

The declaration page plays a vital role in the car insurance renewal process, serving as a comprehensive document outlining the key details of your policy. It’s essential to review your declaration page carefully during each renewal cycle to ensure your coverage aligns with your current needs and circumstances.

Reviewing Your Declaration Page

It’s crucial to review your declaration page thoroughly during the renewal process to ensure that the information remains accurate and reflects your current situation.

- Coverage Amounts: Confirm that your liability limits, collision and comprehensive deductibles, and other coverage amounts are still appropriate for your needs.

- Vehicle Information: Verify that the make, model, year, and VIN of all insured vehicles are correct.

- Driver Information: Double-check the names, addresses, and driving records of all insured drivers.

- Discounts: Ensure that you’re still eligible for any applicable discounts, such as safe driver, good student, or multi-car discounts.

- Policy Period: Confirm the start and end dates of your new policy period.

Potential Changes to Your Policy

As your life circumstances change, your insurance needs may evolve as well.

- New Vehicle: If you’ve purchased a new car, you’ll need to update your policy to include the new vehicle.

- Change in Address: Notify your insurer of any changes to your address to ensure your policy remains accurate.

- New Driver: If you’ve added a new driver to your household, you’ll need to update your policy to include them.

- Change in Coverage: If you’ve experienced a life event such as a marriage, divorce, or the birth of a child, you may need to adjust your coverage amounts or types of coverage.

- Increased Risk: If you’ve moved to a higher-risk area or taken on a new job that involves driving more frequently, you may need to increase your coverage limits.

Declaration Page and Legal Matters

The declaration page, a vital component of your car insurance policy, plays a crucial role in legal proceedings. It serves as a comprehensive document that Artikels the key details of your insurance coverage and can be used as evidence in various legal situations.

Declaration Page as Evidence in Court Proceedings

The declaration page serves as a vital piece of evidence in court proceedings related to car insurance claims. It provides crucial information that helps determine liability and the extent of coverage in case of an accident or other insured event.

- Policy Details: The declaration page clearly identifies the insured individual or entity, the vehicle covered, the policy period, and the insurance company issuing the policy. This information is essential for verifying the validity of the insurance policy and confirming the insured’s rights and obligations.

- Coverage Limits: It details the specific coverage limits for various types of insurance, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. This information is crucial for determining the maximum amount of financial compensation that can be claimed under the policy.

- Deductibles: The declaration page clearly states the deductible amounts for each type of coverage. Deductibles are the out-of-pocket expenses the insured is responsible for before the insurance company begins covering the remaining costs. This information is vital for understanding the financial responsibility of the insured in case of a claim.

- Exclusions: The declaration page may also list specific exclusions, which are situations or events not covered by the insurance policy. Understanding these exclusions is crucial for avoiding potential disputes or legal complications regarding coverage.

In a court case involving a car accident, the declaration page can be presented as evidence to prove the existence of insurance coverage, the extent of coverage limits, and the applicable deductibles. This information can be used to determine the amount of compensation that the insured is entitled to receive.

Keeping a Copy of Your Declaration Page

Maintaining a copy of your declaration page is crucial for various reasons, including:

- Proof of Coverage: Having a copy of your declaration page readily available can serve as proof of insurance coverage, which is often required by law for vehicle registration and operation.

- Claims Process: In the event of an accident or claim, a copy of your declaration page can help expedite the claims process by providing all the necessary information to the insurance company.

- Legal Proceedings: As mentioned earlier, the declaration page can be used as evidence in court proceedings, so having a copy readily available can be beneficial in legal disputes.

- Policy Review: Regularly reviewing your declaration page can help ensure that your coverage remains adequate and meets your current needs. It also allows you to identify any potential discrepancies or errors in the policy details.

Common Misconceptions about Declaration Pages

Declaration pages are essential documents for car insurance policyholders. They provide a concise summary of your coverage, but misconceptions can arise regarding their purpose and scope. Understanding the truth behind these misconceptions is crucial for making informed decisions about your car insurance.

Declaration Pages Are the Entire Policy

It’s a common misconception that the declaration page encapsulates the entire insurance policy. While the declaration page provides a summary of key details, it doesn’t contain the full terms and conditions of the policy. The policy itself, which includes the complete set of rules and regulations, is a separate document. The declaration page serves as a quick reference but shouldn’t be considered a replacement for the complete policy document.

Declaration Pages Can Be Used to Change Your Policy

The declaration page is not a tool for making changes to your policy. It simply reflects the current state of your policy. To modify your coverage, you must contact your insurance company and request a policy amendment. The declaration page will be updated to reflect the changes once the amendment is processed.

Declaration Pages Can Be Used to File a Claim

While the declaration page may contain information relevant to a claim, it’s not a substitute for the official claims process. To file a claim, you must contact your insurance company and follow their procedures. The declaration page may be requested as part of the claims process, but it doesn’t initiate or finalize a claim.

Declaration Pages Are Only for Drivers

Declaration pages are not exclusive to drivers. They are essential documents for anyone with an interest in the insured vehicle, including co-owners, lienholders, or anyone who needs to verify coverage. For example, a lienholder may require a declaration page to confirm that the vehicle is insured before releasing the lien.

Declaration Pages Are Only Issued After an Accident

Declaration pages are issued upon policy issuance and updated whenever changes are made to the policy. They are not specific to accidents and are readily available to policyholders at any time.

Declaration Pages Are Not Important for Renewals

The declaration page is crucial for policy renewals. It provides essential information regarding coverage, premiums, and policy terms, which are necessary for determining renewal rates and confirming coverage.

Declaration Pages Are Only Useful for Legal Matters

While declaration pages are important in legal matters, their usefulness extends beyond that. They provide valuable information for policyholders, helping them understand their coverage and make informed decisions regarding their insurance needs.

Declaration Page and Digitalization

The declaration page, a cornerstone of car insurance, is undergoing a significant transformation in the digital age. As technology advances and consumers demand more convenient and accessible services, insurance companies are embracing digital platforms to provide access to this crucial document.

Digital Declaration Pages: A New Era

The shift towards digital declaration pages is driven by several factors, including the increasing adoption of smartphones and tablets, the growing demand for online services, and the need for insurance companies to streamline their operations.

Insurance companies are implementing digital platforms that allow policyholders to access their declaration pages online, eliminating the need for physical copies. This digital shift brings several benefits, including:

- Enhanced Convenience: Policyholders can access their declaration pages anytime, anywhere, using their smartphones, tablets, or computers.

- Improved Efficiency: Insurance companies can process requests for declaration pages more quickly and efficiently, reducing wait times and paperwork.

- Reduced Costs: By eliminating the need for printing and mailing physical copies, insurance companies can reduce their operational costs.

- Increased Security: Digital platforms offer enhanced security measures to protect sensitive information.

- Environmental Sustainability: By eliminating the need for paper, digital declaration pages contribute to a more sustainable environment.

Examples of Digital Platforms

Several insurance companies have implemented digital platforms that provide access to declaration pages. For example, some companies offer online portals where policyholders can log in and access their documents. Others have developed mobile apps that allow policyholders to view their declaration pages on their smartphones.

Benefits of Digital Declaration Pages

The benefits of having a digital declaration page extend beyond convenience. Here are some key advantages:

- Easy Sharing: Digital declaration pages can be easily shared with others, such as lenders or repair shops, via email or online platforms.

- Real-Time Updates: Digital platforms allow insurance companies to update declaration pages in real-time, ensuring that policyholders always have the most current information.

- Personalized Access: Digital platforms often allow policyholders to customize their access, such as setting up alerts or notifications when their declaration page is updated.

Summary

Understanding the declaration page is a crucial step in navigating the world of car insurance. It’s a document that empowers you to confidently manage your policy, ensure you have the right coverage, and navigate the claims process smoothly. By keeping a copy of your declaration page readily available, you’ll be well-equipped to handle any unexpected situations that may arise.